Credit Accelerator – New Feature

Credit Accelerator, the newest premier product in Envestnet | Yodlee’s suite of tools. FastLink, the industry-leading aggregation technology, has been leveraged to allow lenders to compile a holistic and robust view of their clients’ financial positions, allowing lenders to focus on creating competitive offers, minimizing risk, and increasing loan completions.

Envestnet | Yodlee is uniquely positioned to leverage over 20 years of data collection and analysis to introduce this new, market-disrupting tool, offering more than 3,000 possible data attributes. This solution will lead the industry to safer and more informed decision-making that is better for both borrowers and lenders.

Credit Accelerator offers easy-to-read summaries of critical data, including, but not limited to the following:

|

|

|

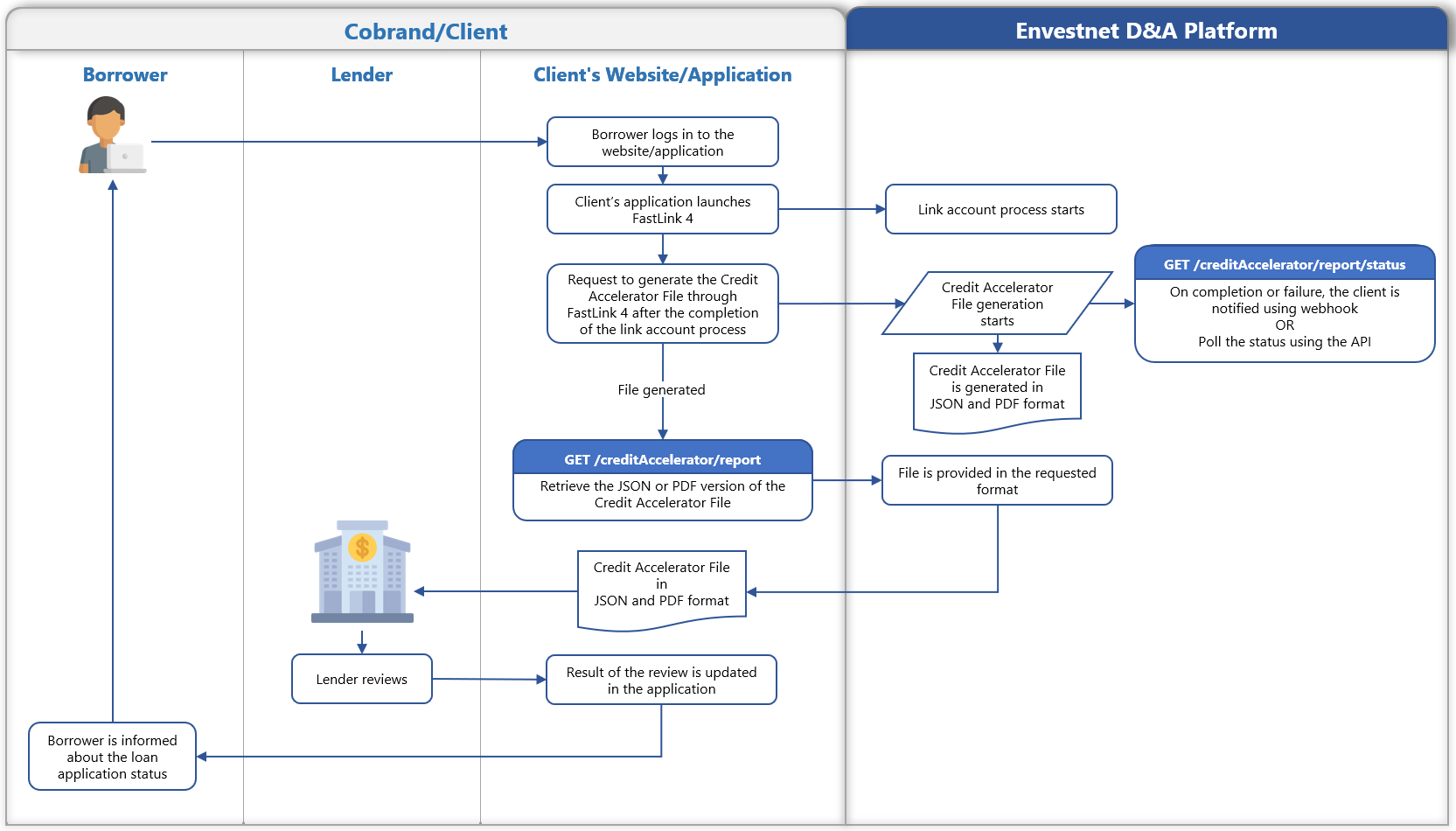

Using Credit Accelerator is easy:

Step 1: The borrower is prompted to link their financial accounts.

Step 2: Envestnet | Yodlee will aggregate the account data and compile the Credit Accelerator file (PDF or JSON).

Step 3: Lender reviews, assesses, and determines how to proceed.

See the May 2023 release notes for further details on the implementation and use of Credit Accelerator. To get started on Credit Accelerator, contact us today!

As we continue to develop this new tool, our product team looks forward to partnering closely with industry-leading experts to ensure industry gaps are being addressed through iterative updates and enhancements. Send questions and ideas for improvement here.

FastLink and Configuration Tool – New Features/Enhancements

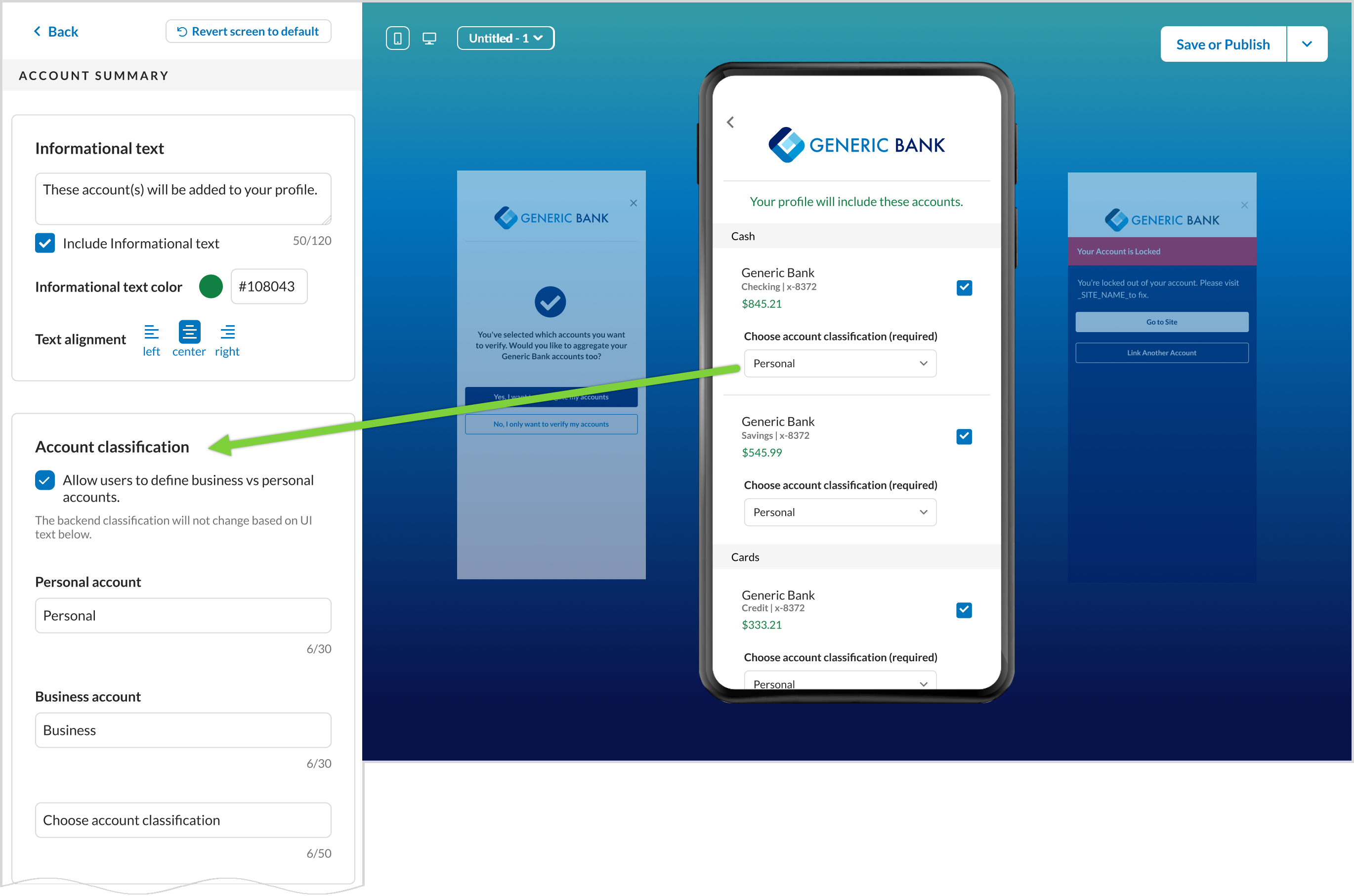

Classify Personal and Business Accounts via FastLink

Account owners will now be able to classify their financial accounts as personal accounts or business accounts via the FastLink Account Summary and Account Selection screens. This optional add-on can be enabled in the Configuration Tool for the Account Summary and Account Selection screens.

The userClassification attribute in the following Yodlee APIs can be used to get the BUSINESS or PERSONAL values:

- Get Accounts -

- Get Account Details -

By default, the classification is Personal, but the customer can change the selection to Business if needed. A customer can switch back and forth between Business and Personal account designations, which helps when a user accidentally chooses the wrong classification.

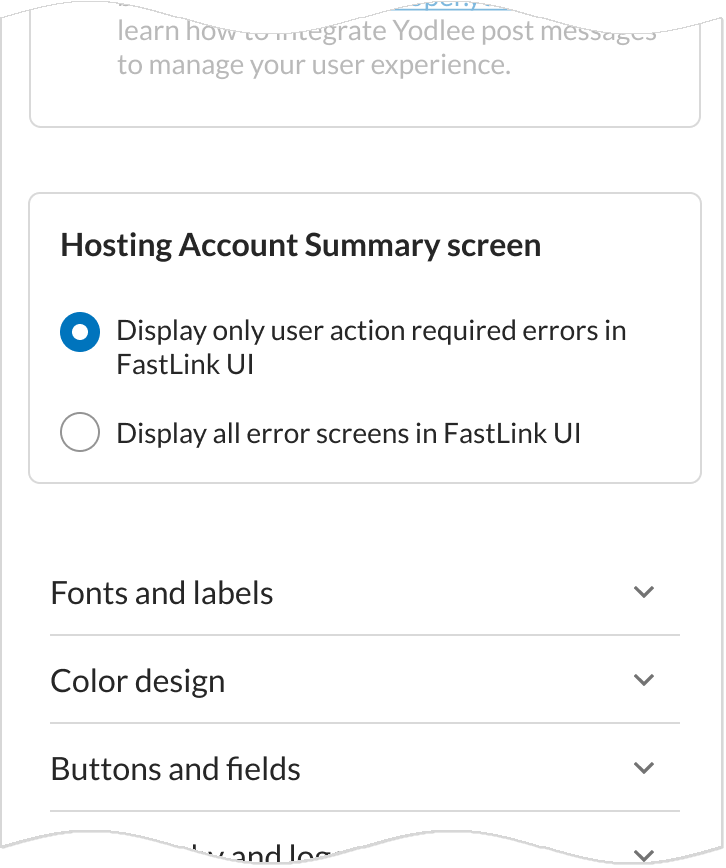

Display ALL Error Screens

Current Experience: When the Account Summary screen is disabled in the Configuration Tool, site and technical errors are not displayed in FastLink. Only User-Action-Required (UAR) errors are displayed, while site and tech errors must be handled by the customer.

New Experience: ALL errors will be shown to the consumer within FastLink. This ensures that the consumer understands the status of their account aggregation attempt and the customer need not create an additional treatment to surface the site and tech errors. The default behavior, i.e., only displaying UAR errors, is not being changed, but it is recommended to show ALL available error screens. Doing so will ensure no discrepancies in consumer communication and user experience.

This applies only to Aggregation, Verification, Aggregation + Verification, and Verification + Aggregation products. To manage the setting in the Configuration Tool, navigate to Global Settings → Enable additional features → Hosting Account Summary screen.

Note: This setting is configurable only when a customer disables the Account Summary screen and opts to host their own. All error screens will be enabled by default when using the default FastLink experience that includes the Account Summary screen.

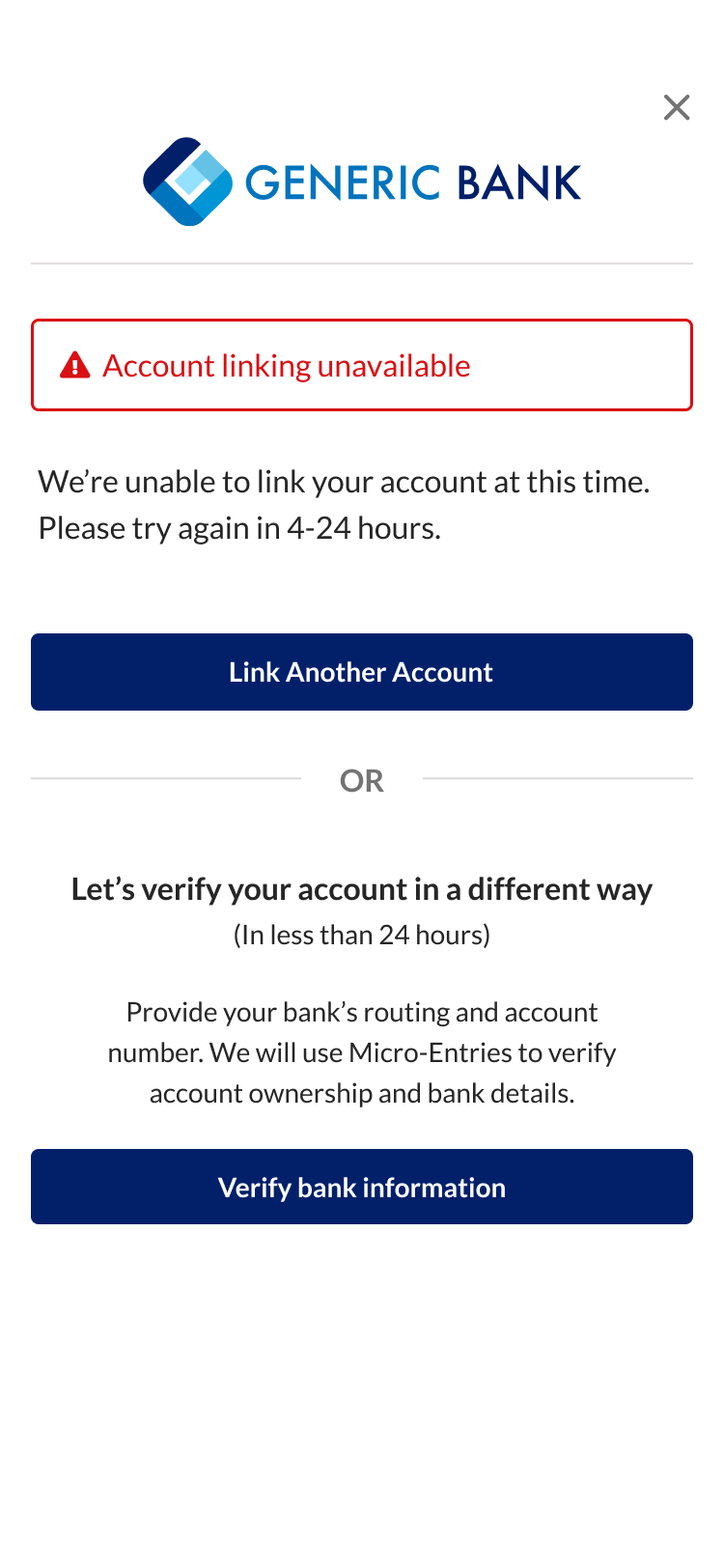

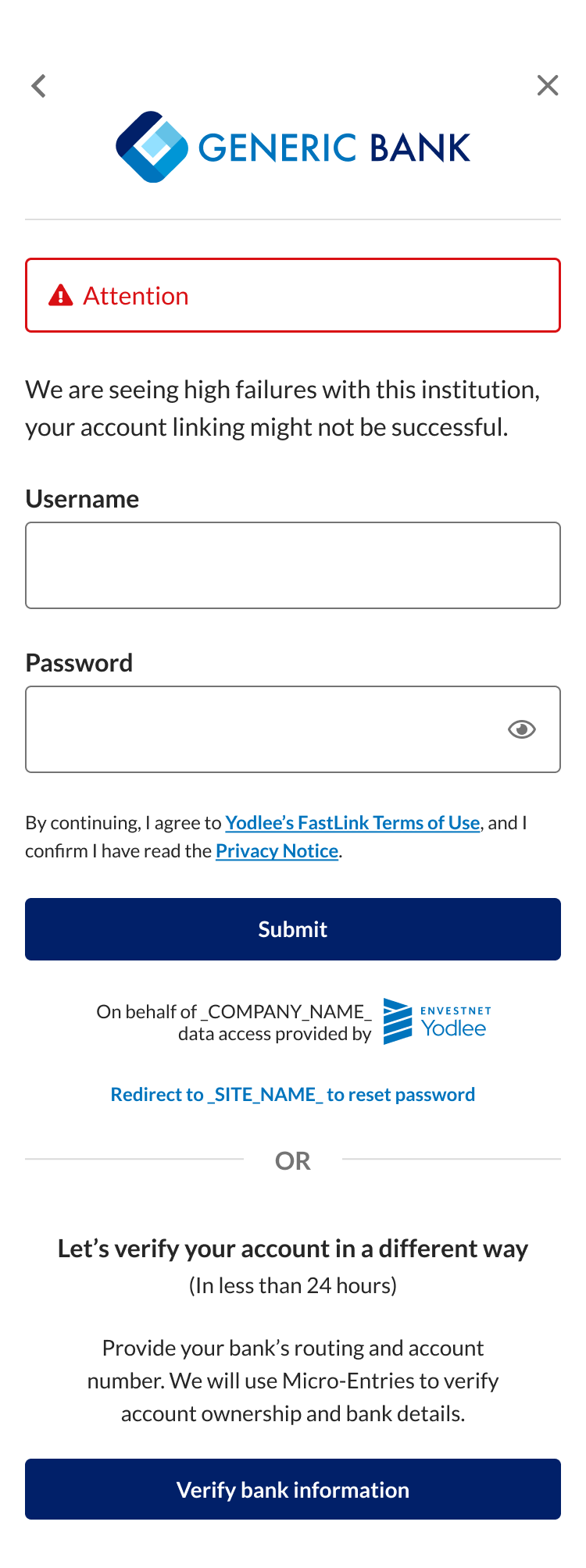

Proactive Site Alerts

Proactive site alerts are now available for multi-factor authentication sites, and customers with the Asset Transfer Verification product. When a site fails 90-99% of the time, an alert will be displayed in FastLink informing the consumer about the same. The consumer will be able to enter their credentials and have a 10% chance to complete the process.

The site alert verbiage has been updated. The text can also be customized; however, it is not recommended. The alternative verification method - Micro Entries - can now be added to both alert screens. Micro Entries can be enabled in the Configuration Tool by navigating to Set preference → Micro Entries.

Other Configuration Tool Enhancements

The following Configuration Tool enhancements have been done:

- Support for Micro Entries has been added to the Aggregation + Verification flow.

- Increased field corner radius from 7px max to 12px max.

- Increased button radius max from 30px to 32px max.

- Increased the character limit on Retrieving Data screen to 60 characters max.

- Added configuration option to bold the account name on the Account Summary and Account Selection screens.

- Modal Cards –

- Added corner radius configuration.

- Added optional shadow configuration.

- Added ability to upload your own Search bar icon.

Open Banking – New Features/Enhancements

US Open Banking

Simplifying the Intent to Consent Screen

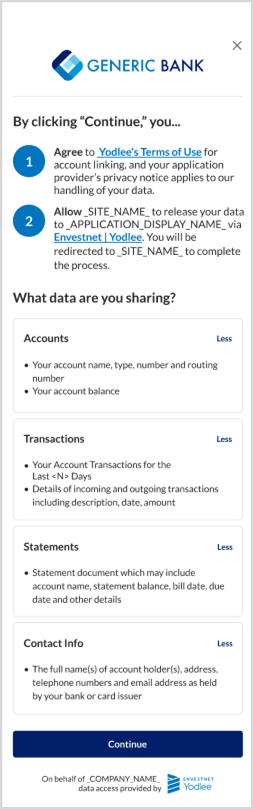

Enhancements in the Intent to Consent screen for the US customers have been done, where subtle changes to the screen have been introduced. These changes apply to the existing and new users and will not affect the data access approved by the consumer. Instead, will enhance the screen layout and help consumers understand the data they are sharing.

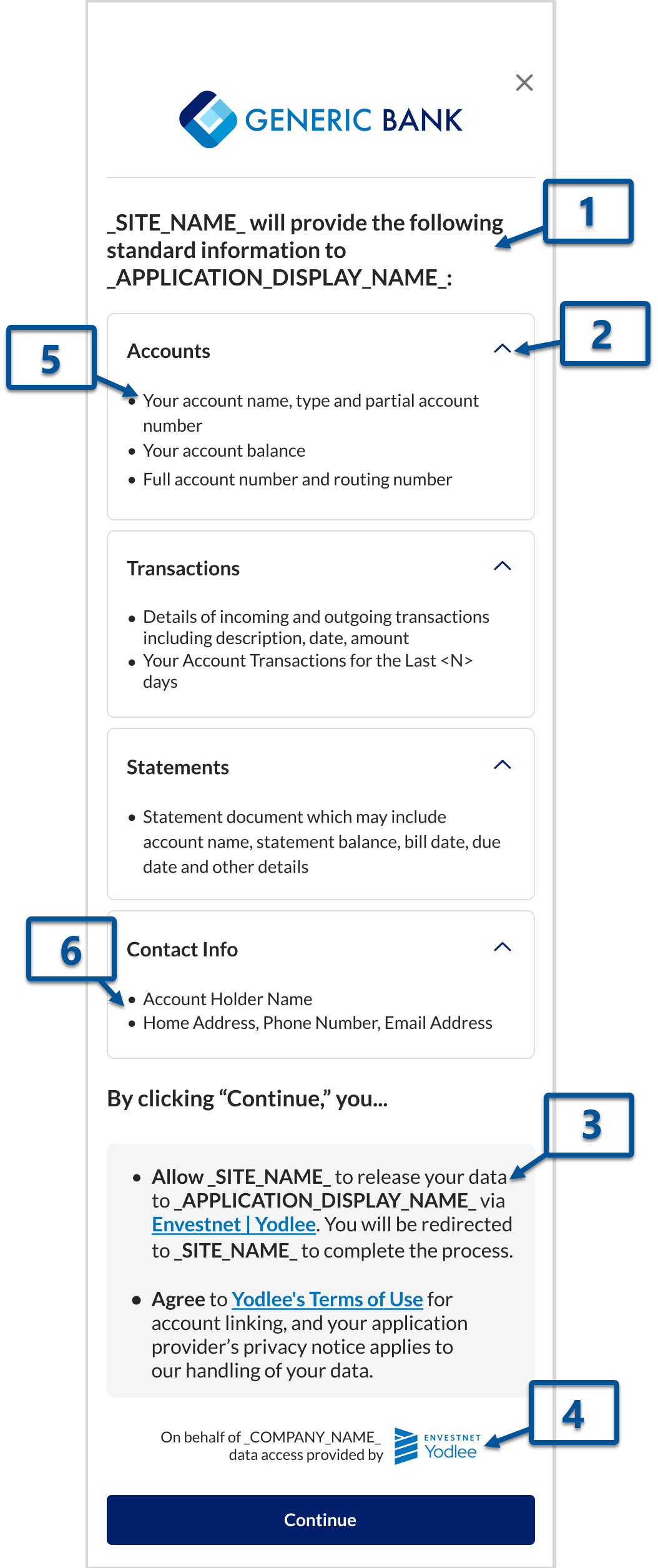

Following changes apply only to FastLink 4 customers:

- The heading of the data cluster segment will be changed from ‘What data are you sharing?’ to ‘_SITE_NAME_ will provide the following standard information to _APPLICATION_DISPLAY_NAME_:”. This change can be verified in the Configuration Tool as well.

- The More/Less button in the data cluster section Accounts, Transactions, Statements, and Contact Info will be replaced with up/down arrow button.

- Terms & conditions segment changes –

- The terms & conditions section, which was at the top of the page, has been moved below the data cluster section and above the Continue button.

- The sequence of the Agree… and Allow… statements have been interchanged. The Allow… statement will be first followed by the Agree… statement.

- The _SITE_NAME_&_APPLICATION_DISPLAY_NAME_ in the Allow… statement point will be in bold font.

- The numbering of the Agree… and Allow… statements will be replaced by bullet points for all customers. In the Configuration Tool, customers can still choose to go back to the numbering format.

- The logo and text below the Continue button will be moved above it. Since the Continue button is static on the screen, the logo and text will be visible only when the user scrolls to the bottom of the screen or if the entire screen is visible without the scroll bar.

The following data cluster changes apply to all FastLink 4, FastLink 3, and Yodlee API v1.1 customers:

- Accounts data cluster changes –

- The existing data cluster description will be changed to ‘Your account name, type and partial account number’, and the ‘Your Account Balance’ description will be unchanged.

- The newly added description ‘Full account number and routing number’ will be displayed only if the corresponding dataset is requested.

- Contact Info data cluster changes – The existing data cluster description will be split into the following two statements that will be displayed based on the requested dataset.

- ‘Account Holder Name’ will be displayed only if the ACCT_PROFILE.HOLDER_NAME or ACCT_PROFILE.HOLDER_DETAILS dataset is requested.

- ‘Home Address, Phone Number, Email Address’ would be displayed only if the corresponding dataset ACCT_PROFILE.HOLDER_DETAILS is requested.

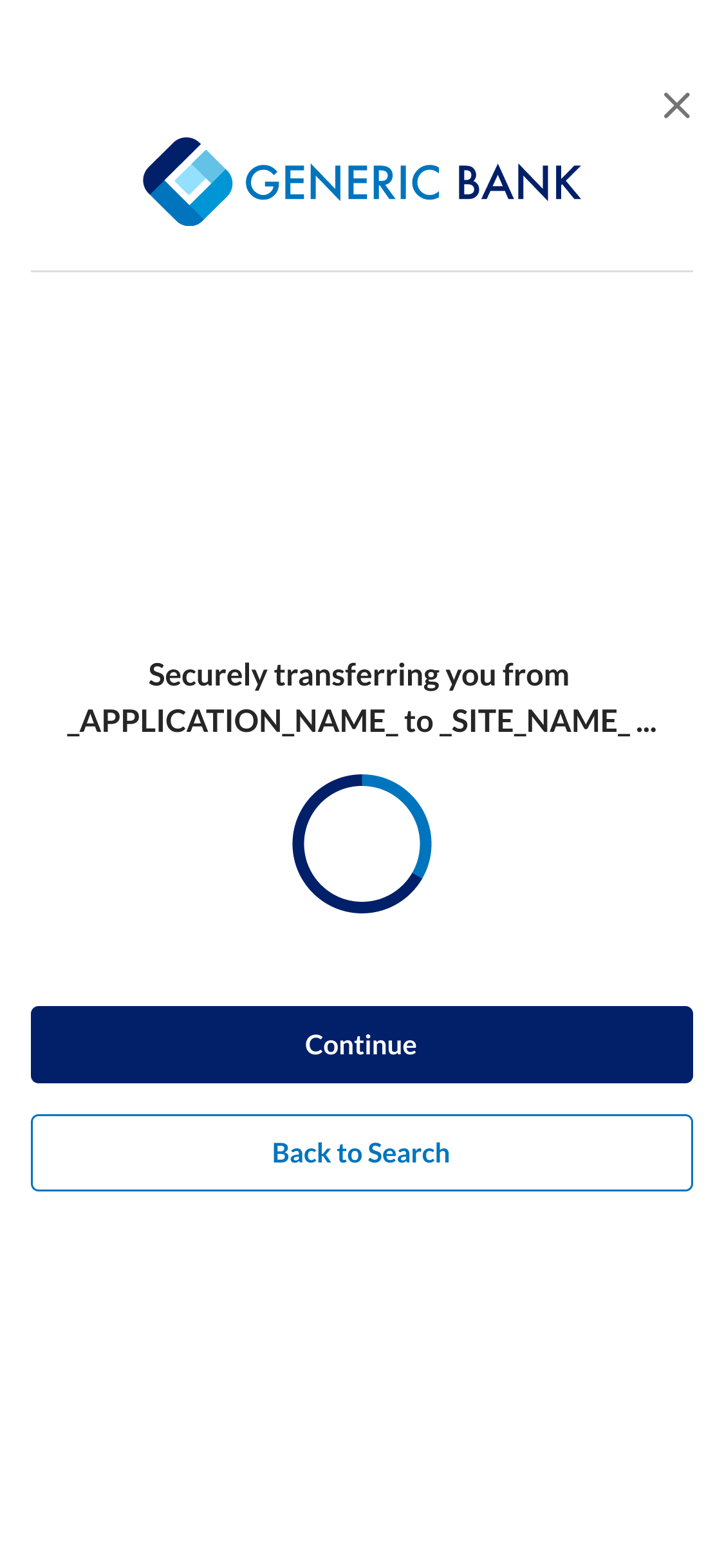

Continue Button Added to the Intermediate FastLink Screen

Current Experience: After clicking Continue on the consent screen, the consumer is securely transferred to the Financial Institution’s (FI’s) site, which is opened in a separate tab via an OAuth connection. If the consumer returns to the intermediate FastLink screen, the options available are to exit or return to the search page.

New Experience: The Continue button is added to the intermediate FastLink screen. If the user minimizes the FI’s OAuth site tab and returns to the FastLink intermediate screen, clicking the newly introduced Continue button takes the consumer back to the FI’s OAuth site to continue with the account-linking process.

AU Open Banking

Consent Configuration Enhancements

Enhancements have been made to provide accredited customers the flexibility to configure most consent screen text in the Australian Open Banking consent flow. CDR Representative customers will be able to make text-modifications with approval and assistance from Envestnet | Yodlee. Note that the consent screens must include certain information and statements required by the Consumer Experience Guidelines, the Consumer Experience Standards, and the CDR Rules.

The following Consent screen text can be modified:

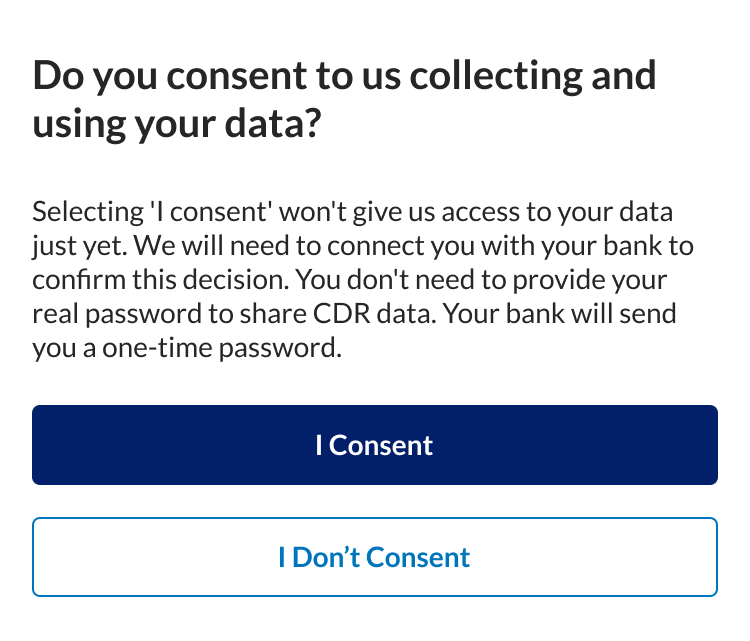

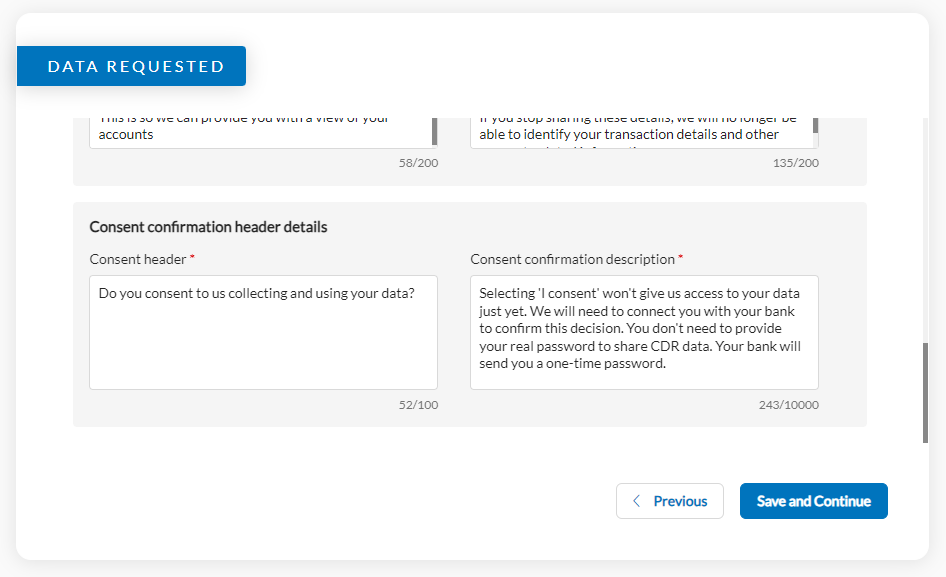

- Consent confirmation text –

In the edit Open Banking application flow, custom text for both header and statement can now be added in the Data Requested screen of the Configuration Tool. In the Data Requested screen, scroll down to the Consent confirmation header details section to view the predefined and edit the default text.

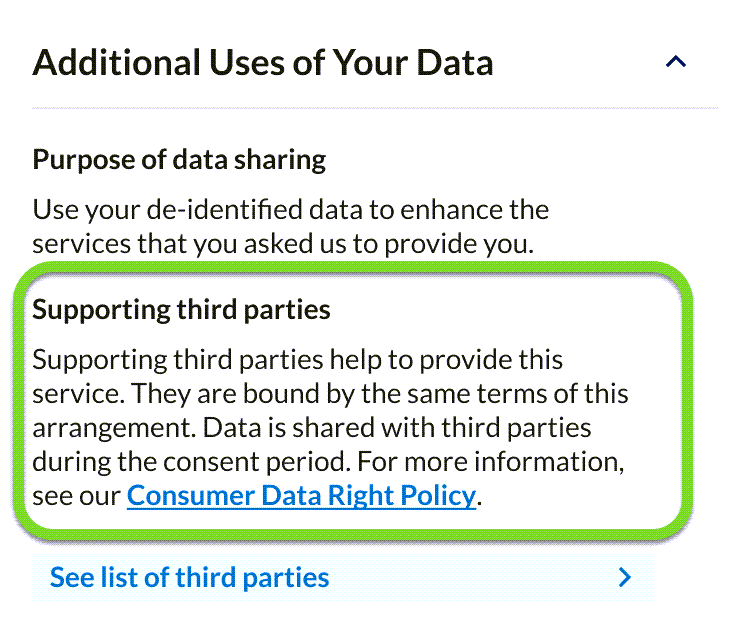

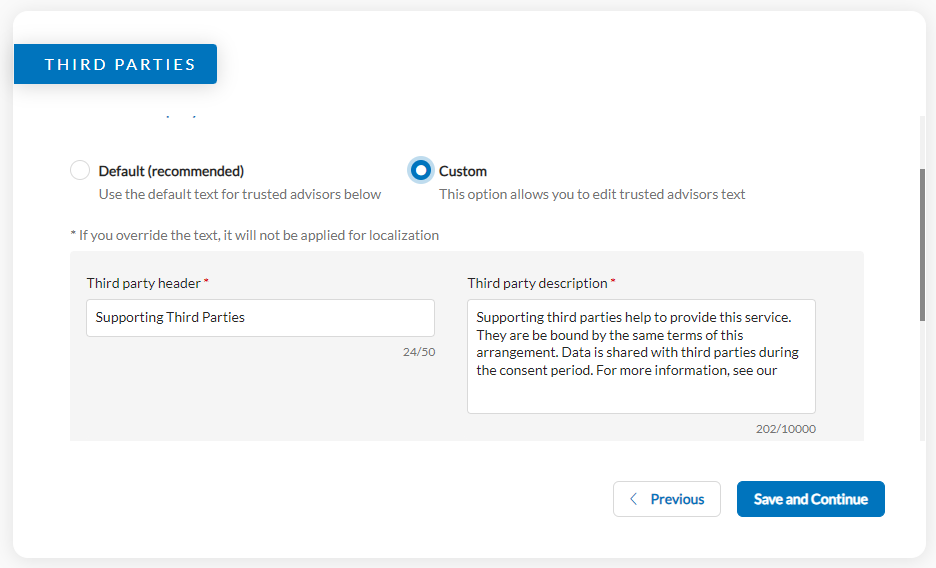

- Supporting third parties text –

The Supporting third parties text can now be modified in the edit Open Banking application flow in the Third Parties screen of the Configuration Tool:

Note: Customers who onboarded AU Open Banking with the CDR Representative model cannot access this section. CDR Representative customers can contact Envestnet | Yodlee Client Services team to make the required changes. - Deletion preferences text –

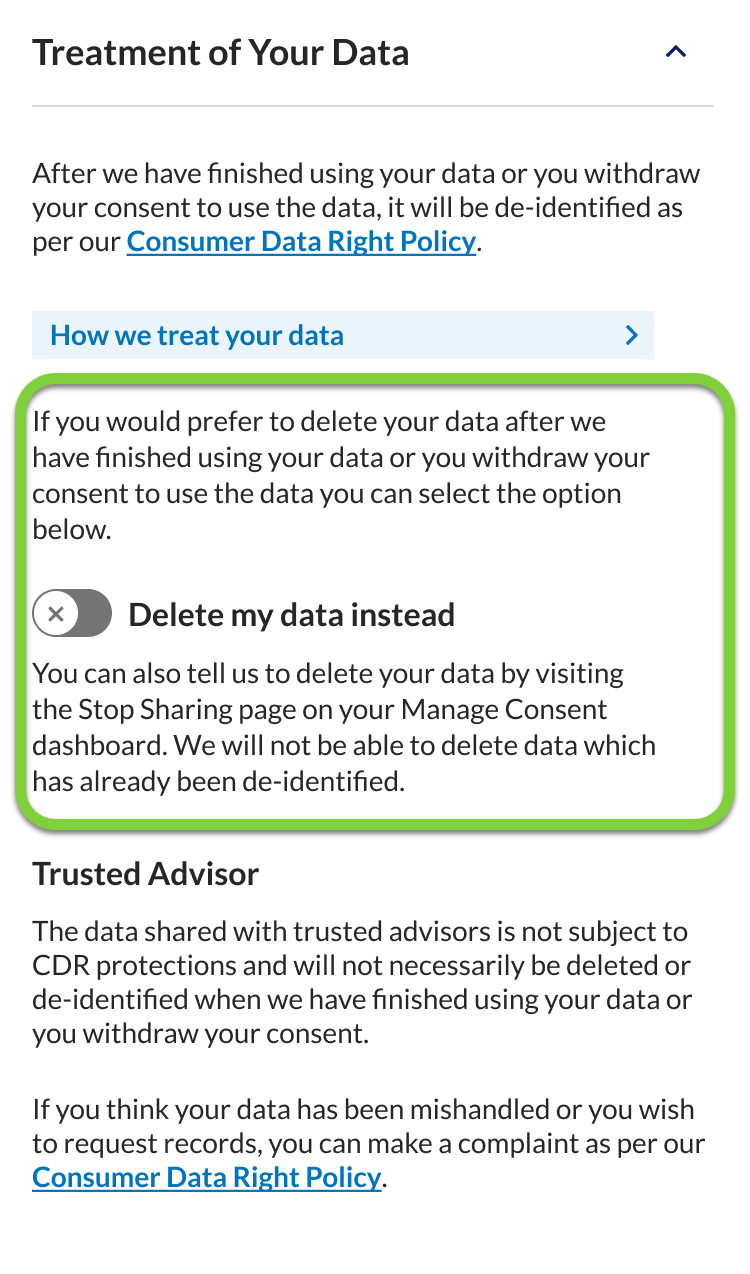

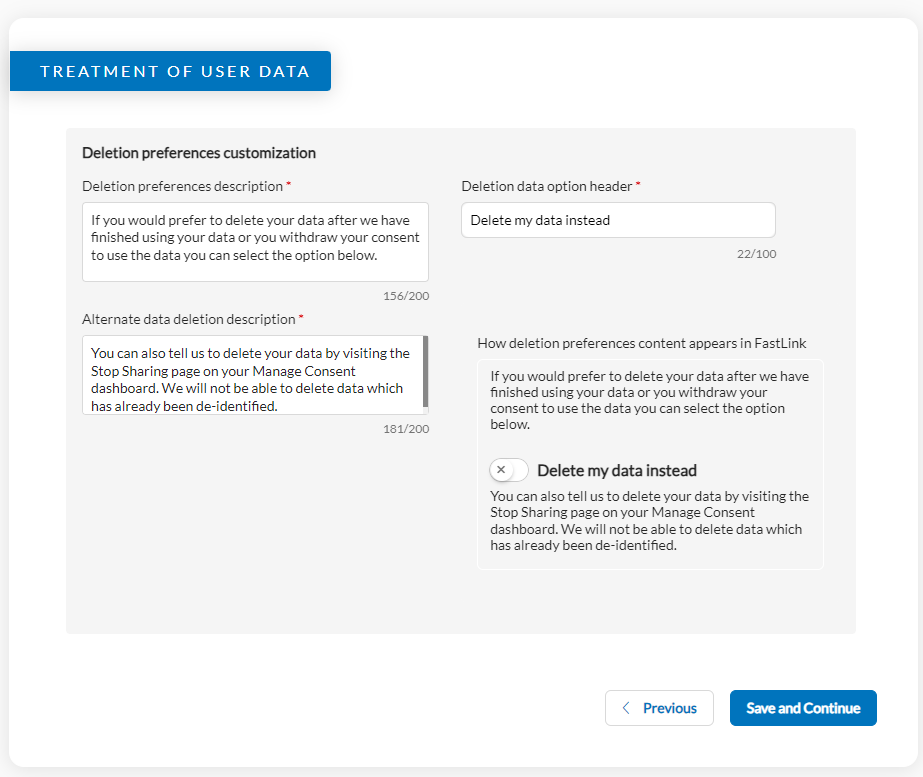

The Delete my data instead label and the text above and below the toggle button can be modified in the edit Open Banking application flow in the Treatment of User Data screen of the Configuration Tool.

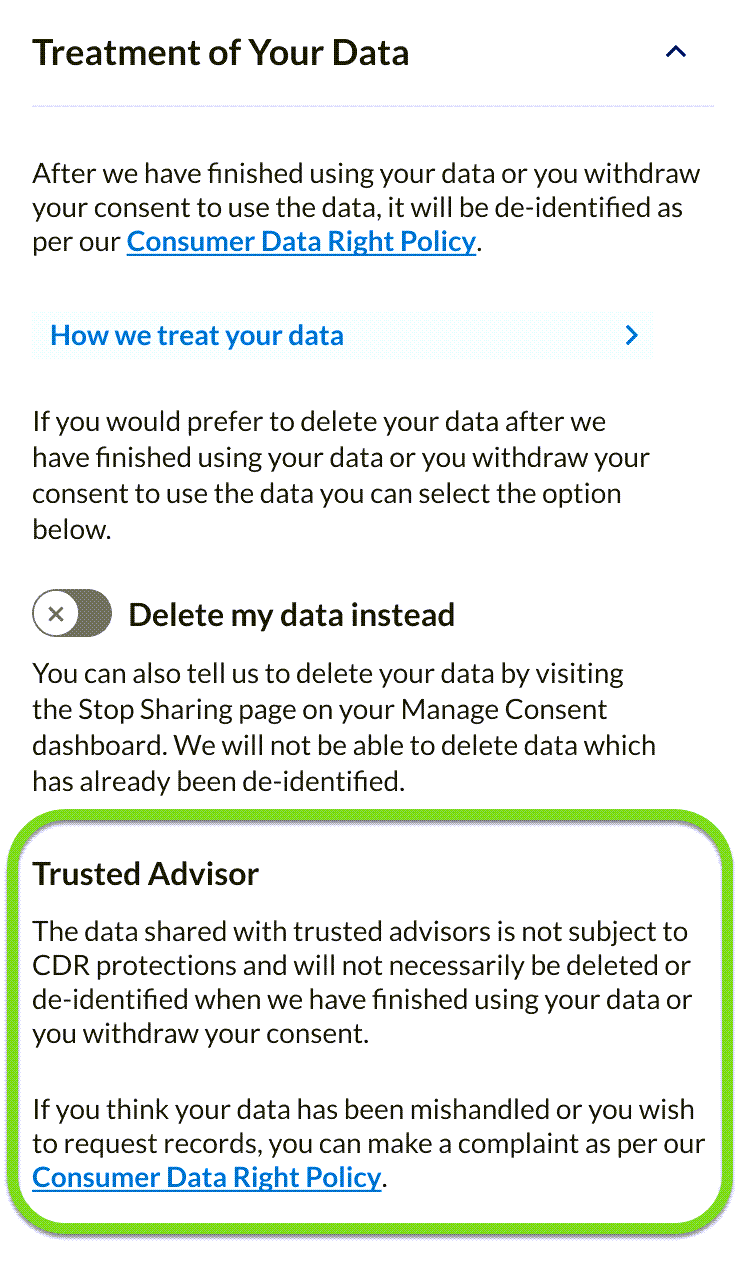

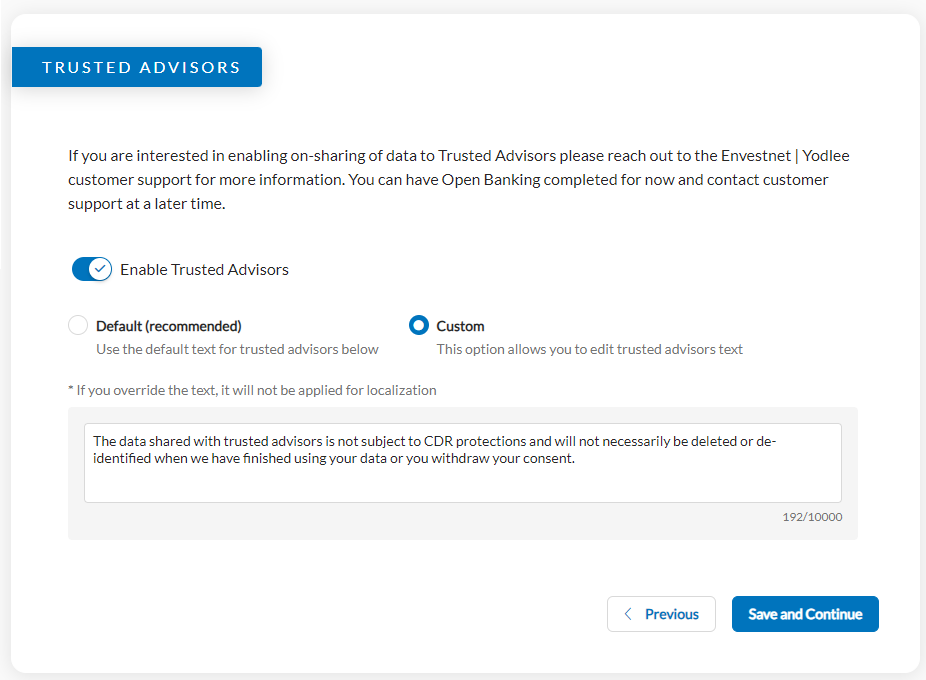

Note: This section cannot be accessed by customers who onboarded AU Open Banking with the CDR Representative model. CDR Representative customers can contact Envestnet | Yodlee Client Services team to make the required changes. - Trusted Advisors section text –

For customers using the Trusted Advisor disclosure consent feature, only the first paragraph in the Trusted Advisor section of the consent screen can be modified. Custom text can be provided in the Trusted Advisor screen of the Configuration Tool.

Transaction Data Enrichment – New Features/Enhancements

Pure Loan Enrichment

As part of continuous improvement, the following merchant-related fields will no more be part of pure loan enrichment:

merchantCountrymerchantTypeisPhysicalisRecurring