FastLink and Configuration Tool – New Features/Enhancements

Credit Accelerator

Envestnet Data & Analytics Credit LLC is proud to announce our new Credit Accelerator product offering. Acquiring a full picture of a potential borrower’s spending and income history and conducting credit analysis is typically a time-consuming and labor-intensive process. But with Credit Accelerator, you can use our proven data aggregation capabilities to gain a complete picture of your credit applicants and speed up the data analysis process without compromising the results.

How It Works

- Integrate with Envestnet | Yodlee’s Financial Data Platform and Envestnet | Yodlee FastLink to let users add and link their financial accounts.

- Your users can grant permission and link their financial accounts.

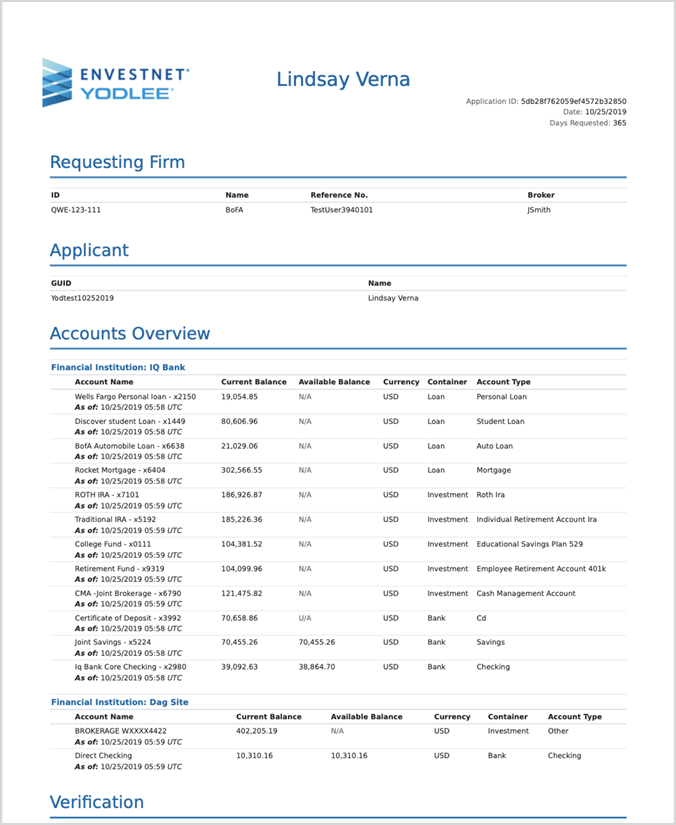

- You receive a comprehensive report via a PDF and/or JSON to help you make better, more informed decisions.

Credit Accelerator Use Cases

- Cash flow underwriting (Acquisition) –

Over 1,000 features feed machine learning algorithms to maximize predictive value. - Verification of deposits –

Provides data for available sources of deposits for up to the last 365 days. - Payments and ACH risk mitigation –

Links bank accounts for automated ACH payments of newly booked loans and returns routing and account numbers to facilitate such.

Expense and Income Analysis

The Credit Accelerator provides an income summary, which delivers detailed information on all sources of income and recurring income streams. It also includes an expense summary that classifies spending into industry-friendly categories to help identify key credit risk and lifestyle factors. Get a complete and accurate view of users’ financial positions for informed credit decisions that meet the Responsible Lending guidelines.

- Transactional and account data –

Transaction level data on DDA assets, investment holdings, and account data such as current balance. - Derived data –

Clarified descriptions and categorizations of transactions leveraging enrichment and data science. - Calculated values –

Rules-driven summarized values derived from transactions either within or across multiple accounts. - Applicant information –

Leverage relevant information in the loan application for comparison and calculated values.

Financial Account Linking Experience

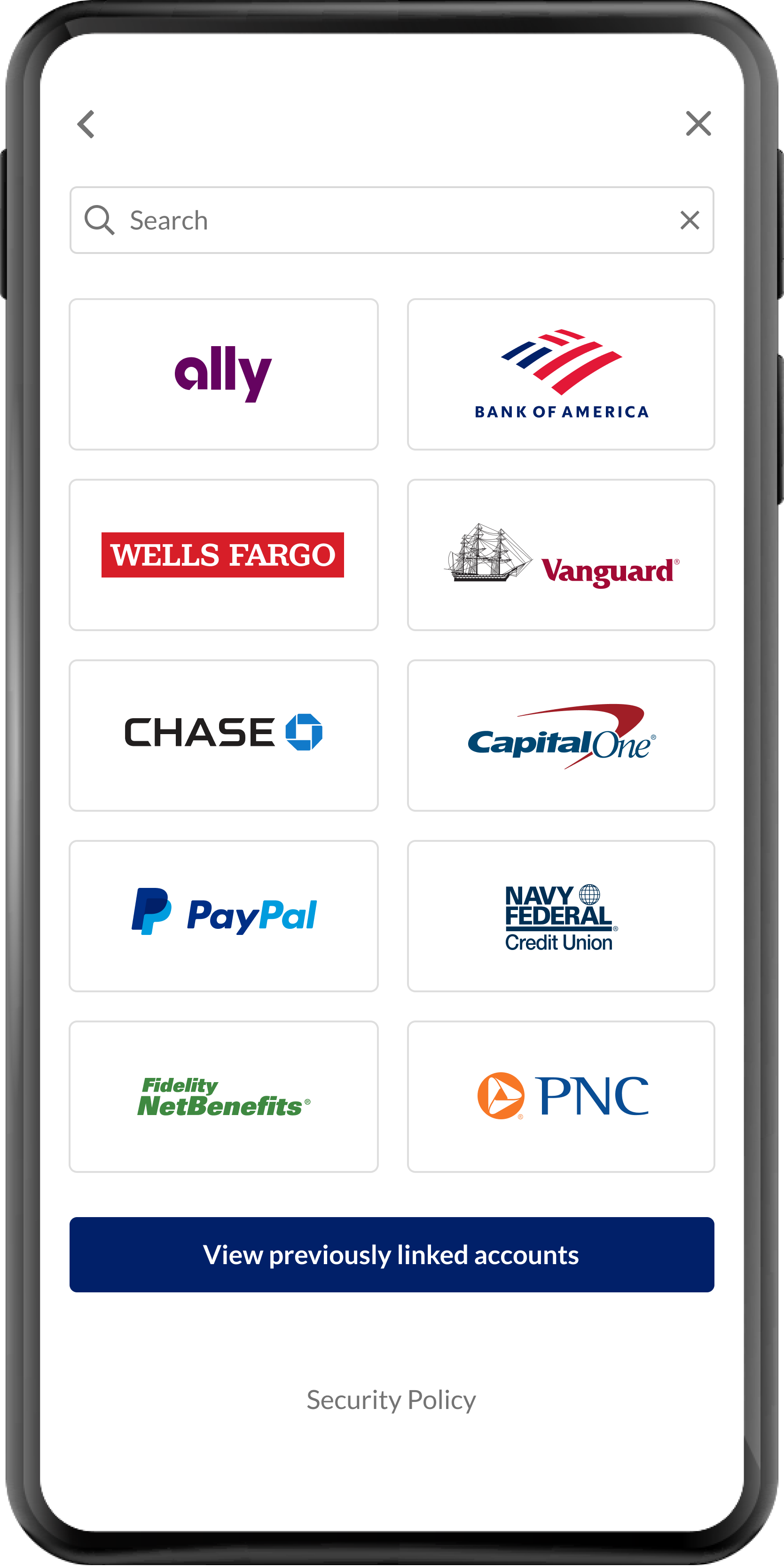

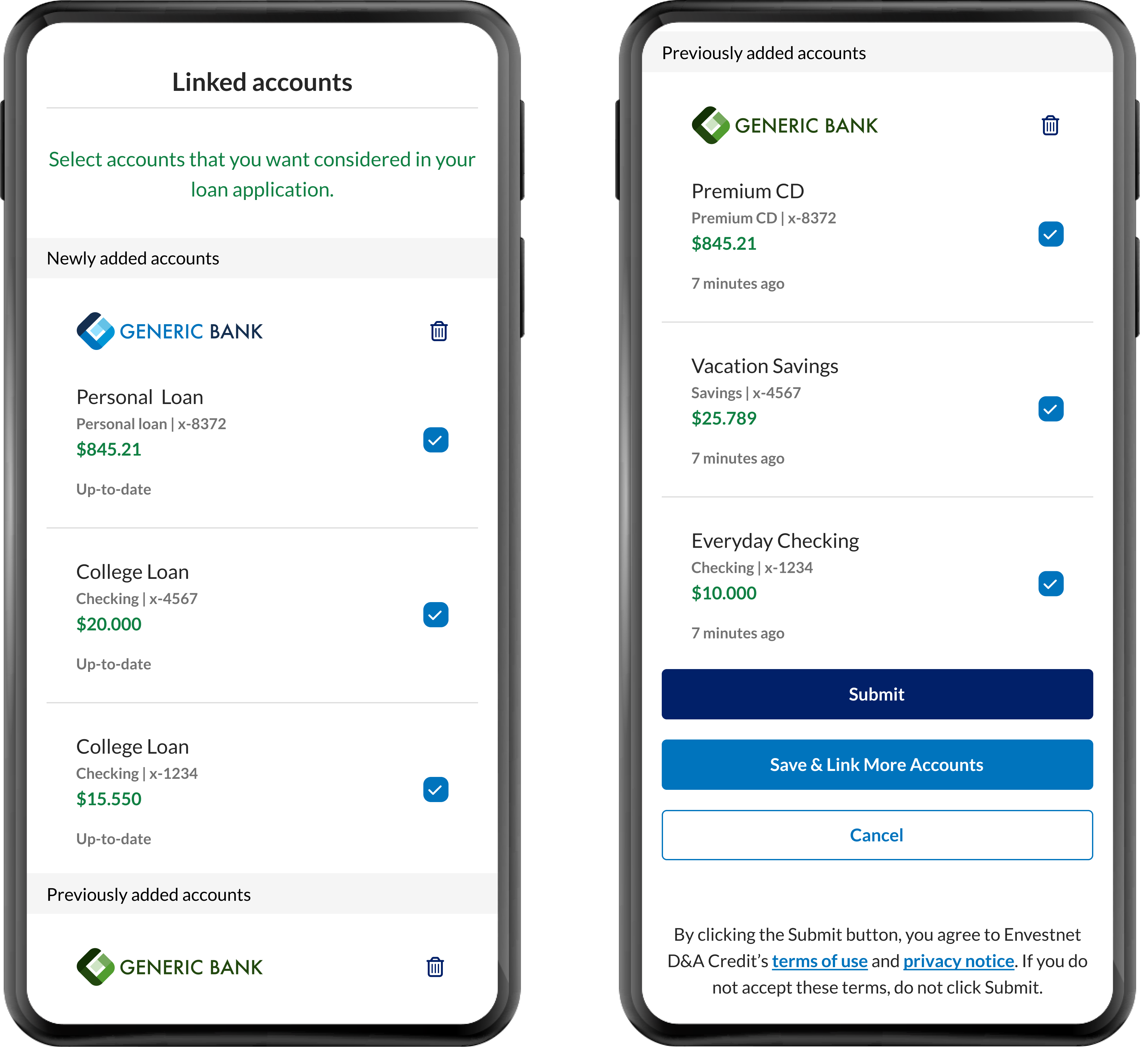

- Applicant searches and selects a financial institution where they have financial accounts.

- Applicant enters their credentials and submits. Credit Accelerator returns all related accounts.

- The applicant can repeat steps 1 and 2 for as many financial institutions as needed until all their financial accounts have been identified.

- The applicant can select some or all their accounts and then proceed by submitting their loan application.

- The applicant can come back to add additional accounts and submit their loan application again.

- Once submitted, the loan officer can generate the Credit Accelerator PDF or JSON file. Following is a sample preview of the Credit Accelerator PDF:

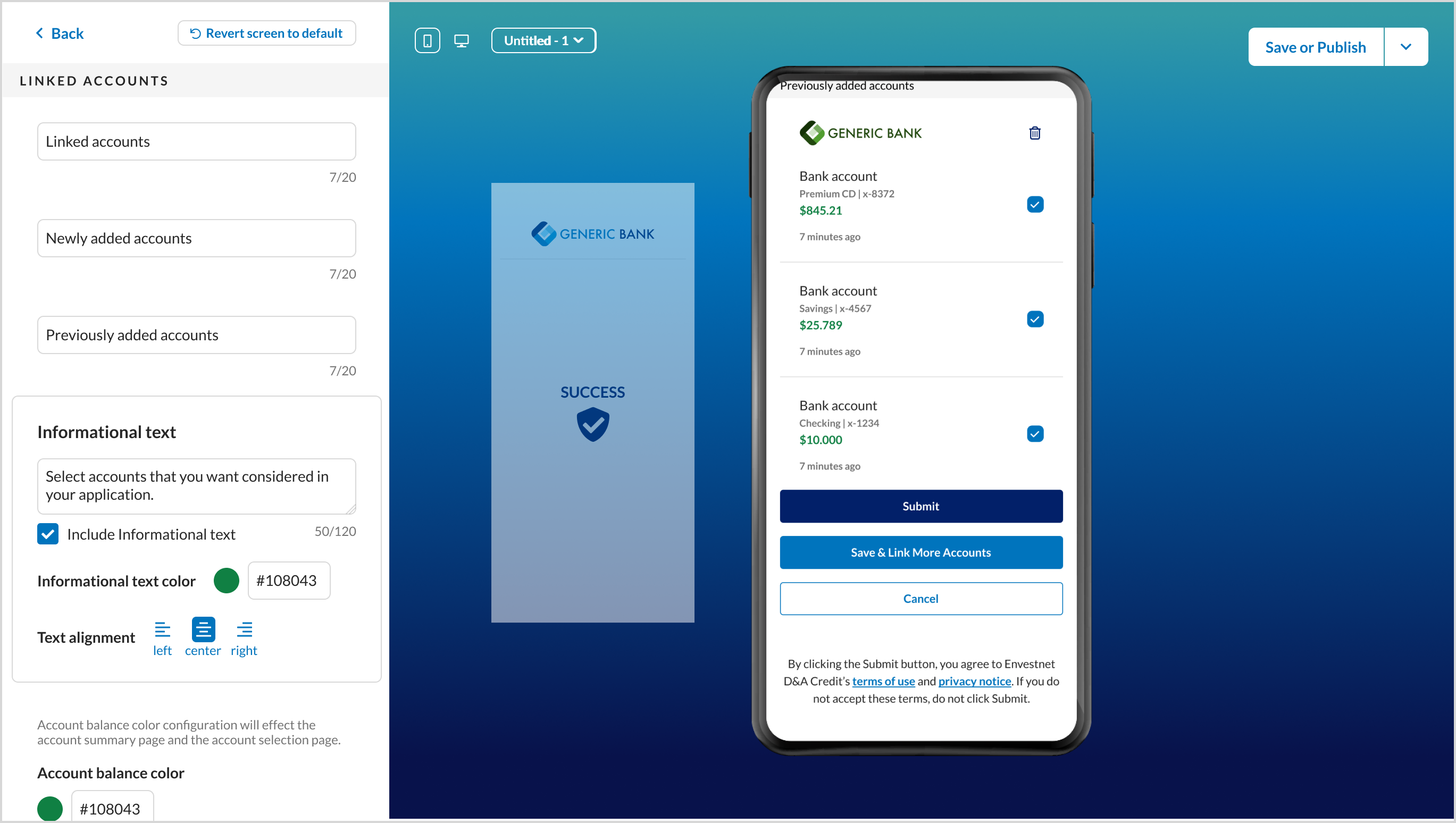

Customize With Ease

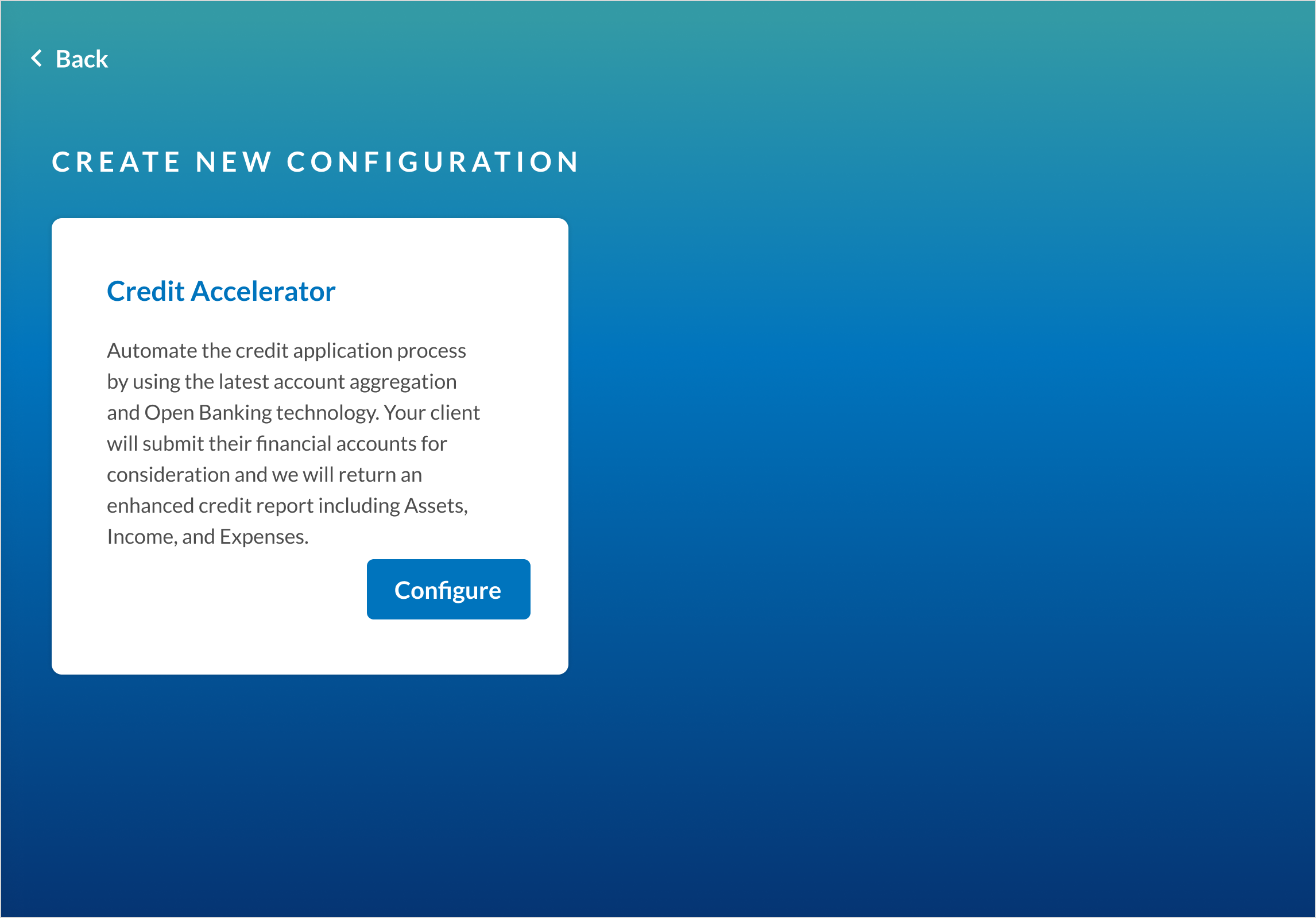

Onboarding, launch, and ongoing management of Credit Accelerator are simple with our robust Configuration Tool. With the tool, view and customize the look and feel of the account linking experience and the resulting PDF. Change settings, colors, buttons, logos, and text in a few minutes, review the previews, and publish.

Next Step

To learn more about this new product offering, contact your Yodlee representative. Also, see Credit Accelerator Documentation.

Non-Essential Cookie Management

Worldwide regulations of non-essential cookies continuously evolve to provide more protection for individuals. In a proactive measure, two ways to better manage non-essential cookies in FastLink have been introduced.

First, what are essential and non-essential cookies?

- Essential cookies are required for daily operations.

- Non-essential cookies are not required for daily operations but are used for generalized user behavior analytics.

New and Enhanced Capabilities

- Customer level enablement/disablement –

Non-essential cookies can now be enabled or disabled at the instance configuration level within the global settings. By default, non-essential cookies will be enabled. (Exception, for the UK region, by default, non-essential cookies are disabled.) - Customer passes the user-specific cookie preferences –

It is the customer's responsibility to manage its user's cookie preferences. This is the recommended method, and the customer-level enablement/disablement settings are intended to be a stopgap until this method can be accommodated by you.- Customers are to send Envestnet | Yodlee the users’ cookie preferences for Envestnet | Yodlee to follow.

- If the users’ preferences change, the customer must send the new preferences to Envestnet | Yodlee.

Good to Know

- UK rules and regulations require that all non-essential cookies be disabled by default, but the user can opt-in if they wish.

- A customer’s cookie preferences will be based on the chosen primary region at the instance level in the Set Preferences section of the Configuration Tool. If the UK region is selected as the primary region, the non-essential cookies will be disabled by default.

- If the primary region is the US, the non-essential cookies are enabled in the global preferences. If the primary location is later changed to the UK, the non-essential cookies will be disabled.

- If the customer sends their user's cookie preferences to Envestnet | Yodlee, the user's individual cookie preference will always override the customer's settings. For example, if the customer setting has disabled cookies, but the user's settings indicate cookies enabled, the non-essential cookies will be enabled for that user.

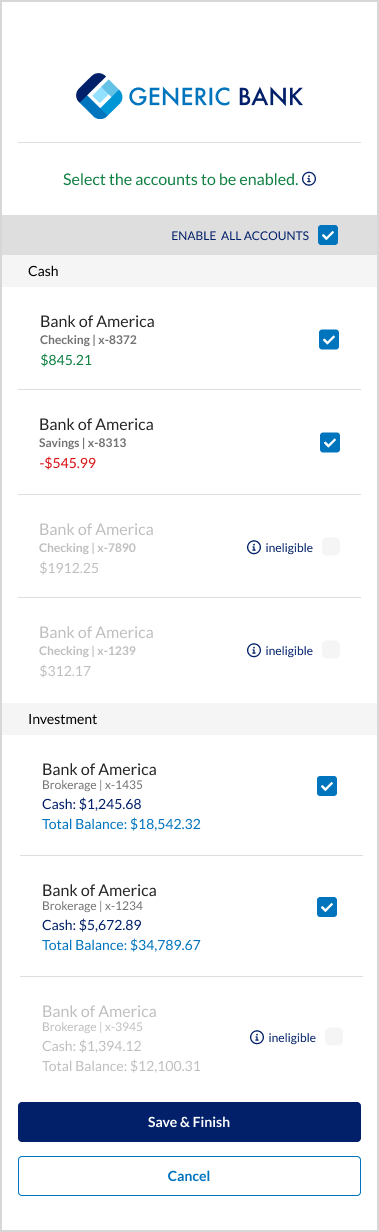

Display Ineligible Accounts in the Verification Flow

Currently, in the account verification flow, accounts ineligible for verification are not displayed on the account summary or the selection screen, which can be a confusing user experience for some users. The user may link their financial account and expect to view all accounts available with that credential but can only view verification-eligible account(s).

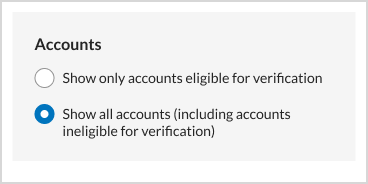

To add transparency to the user experience, an optional configuration has been added to display the ineligible account(s) on the account summary screen. The user can now view all accounts regardless of their verification eligibility. An account may not be eligible for verification if the required verification information, such as the account name or number, is missing.

This feature can be enabled in the Configuration Tool on the account summary/selection screen. The label and help text can also be edited from the same location.

Fiji Provider Sites Available

Support has been extended to allow providers sites from the Fiji region. In the Configuration Tool, Fiji is now available to select in the Allow sites from section.

Open Banking – New Features/Enhancements

All OB-Supported Regions

Default OB Application

Currently, when a customer creates more than one OB application, the OB application name must be explicitly passed while launching FastLink, even for the existing users who are mapped to the initial Production OB application. This enhancement will mark the initial Production OB application as the default OB application. For the users linked to the default OB application, customers need not specifically pass the OB application name. Launching FastLink would not result in an error even if the customer does not pass the OB application name for all the users linked to the default OB application. If customers do not pass any OB application name for new users, these users will be tagged to the default OB application.

Following are the other changes that would happen with this implementation:

- If any existing user is not mapped to any OB application and the customer launches FastLink without passing the OB application name, the user will be tagged to the default OB application.

- Customers will not be allowed to mark an OB application as default; rather, the oldest Production OB application will be automatically considered as the default OB application.

- The default OB application will be displayed in the Open Banking dashboard of the Configuration Tool and Register site application configuration screen of the My Yodlee application.

- If the customer requests to delete the default OB application, all the users associated with this application will not be linked to any application until the customer launches FastLink with an appropriate OB application name.

Reuse OB Application Name

In the recent past, certain validations were added to not allow the reuse of an OB application name across the Envestnet | Yodlee platform. This was primarily done as the application name is an important identifier used by the providers for registration or to identify the unique applications in the platform.

These validations will now be relaxed in certain cases where the OB application was not used for the Production provider registration. Following are the scenarios where the OB application name will not have any restrictions:

- Customers can use any name for their Development OB application, as the Development OB application cannot be used for the Production provider registration. For example, Test OB App.

- Customers can choose to have the same name for the Production and Development OB applications.

- Customers can choose to have any name for the Production OB application. An appropriate error will be displayed if any other application across the platform already has the name.

UK Open Banking

Account Verification Support

As part of this release, account verification support has been enabled for the UK OB region. All the account verification-associated flows, such as the Verification flow, Aggregation + Verification flow, and Verification + Aggregation flow, are enabled.

In this release, account verification will be available for CMA9 banks, and more UK providers will be added to the Verification flow in the subsequent releases. The key highlights are as follows:

- The account verification support will only be enabled for the bank accounts supported through OB and not for investment accounts.

- Both matching and data services for the verification flow will be available.

AU Open Banking

Trusted Advisors Disclosure Consent

The Trusted Advisors (TA) disclosure consent feature will give the ability to CDR customers to request, edit, and renew consent from end users to disclose data to TAs outside the CDR as allowed by the CDR rules. For more information on TA, see the OAIC page. The feature requires customer-side integration and implementation to allow users to nominate a TA, and customers need to persist the TA chosen by users as part of their implementations.

Customers will have to develop and implement their own flows for TA selection and provide the list of TA associated with each consent during the add, edit, and renew consent flows. For this reason, customers will need to persist the TA associated with each consent on their side.

Customers will have to comply with the CDR rules during the TA selection process, including taking reasonable steps to verify that a TA meets the definition under the rules.