Data Access and FastLink – New Features/Enhancements

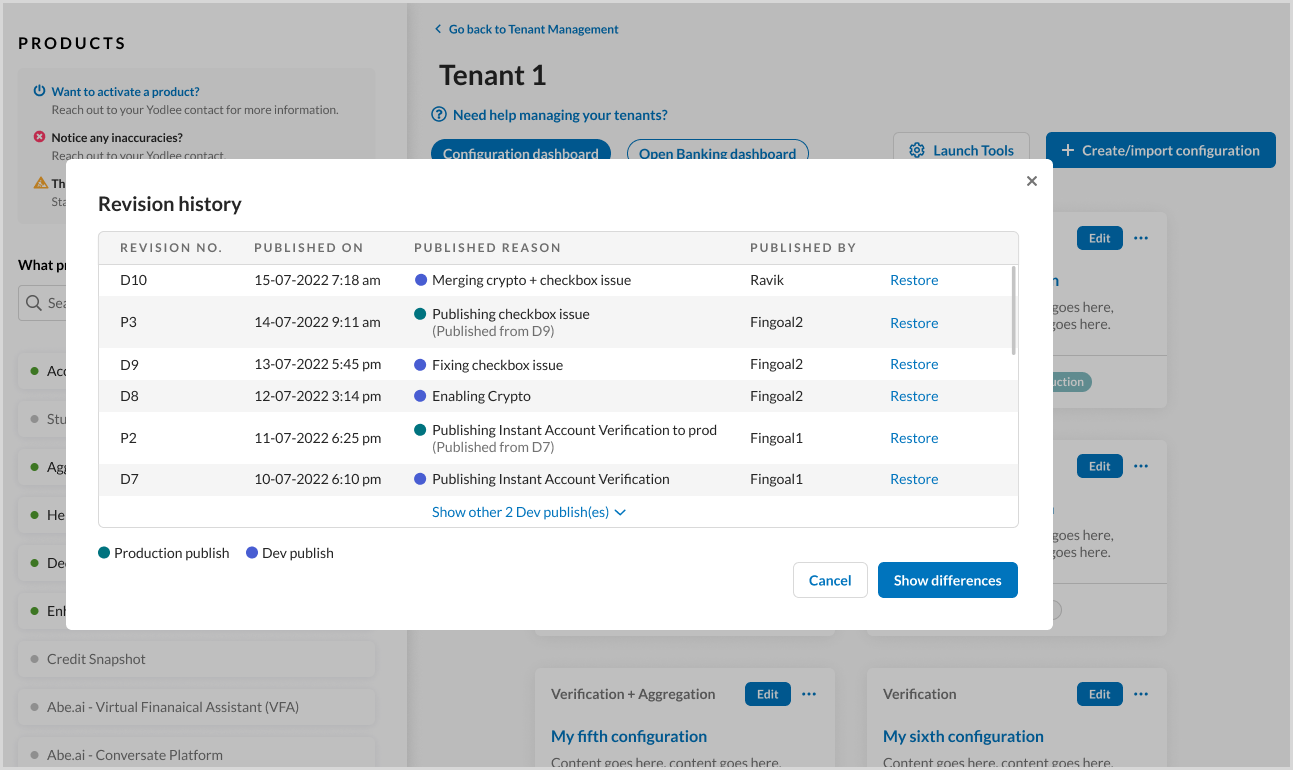

Restore Production and Development Versions

Both the Production and Development versions' Configuration settings can now be instantly restored to a previously published version. A max of three Production versions can be displayed and restored.

Note: This restore functionality was built as a backup option and should be used sparingly. The best practice is to change the required settings in the configuration tool itself.

To restore a previously published version, follow these steps:

- On the Configuration dashboard, click ... for the configuration instance that has to be restored.

- Click Revision History.

- Click Restore for the revision version that needs to be restored.

- Once restored, return to the Configuration dashboard, confirm that the settings are accurate, and continue working. Republish when ready.

Account Verification – New Features/Enhancements

User Classification Support

For Micro Entries (earlier referred to as challenge deposit verification flow), the verification APIs have been enhanced to accept and retrieve the user account classification as an optional attribute. The user account classification is an ENUM that holds the following two values:

PERSONAL– Indicates a personal account.BUSINESS– Indicates a business or a small business account.

| Impacted API URLs: |

User Registration: Support for Phone Number

Enhancements have been made to the user details APIs to accept and retrieve the phone number as an optional attribute. Currently, there is no provision to capture the users’ phone numbers during registration or update them later.

Similar to the email, an option to enter the phone number will be available as an optional field during user registration. Appropriate validations for the phone number have been introduced, such as checks on length, format, and special characters, and a suitable error message will be displayed where necessary. The GET APIs can retrieve these details and update them using the PUT calls.

For the FastLink 4 flows that require a phone number, the phone number entered during the SAML login or registration will NOT be honored. An option to enter the phone number will be provided on the screen if needed.

| Impacted API URLs: |

Account Verification through Matching Service: Support for French Characters

Currently, there is no support for matching any French characters/accents. The matching service account verification fails if there is a deviation in how the name is registered versus the name retrieved from the financial institution.

Enhancement has been done to the matching service logic to support the French alphabets/accents. The matching will be successful even if it has to be performed on names with French characters, thus increasing the success rates.

| Impacted API URL: |

Data Solutions – New Feature

Account Token

Account verification customers providing digital payment services can eliminate the risk of storing users' sensitive financial account information using Account Token endpoints. The endpoints allow customers to create an account-specific token that the payment processors can use to retrieve account information.

Our payment processor partners can use this token to retrieve the following account information to process payments:

- Account holder information such as name, email, phone number, address, etc.

- Account information, including account name, account number, type, transfer code (for example, routing number of the bank account in the US), etc.

- Account balance information.

Account Token APIs for Verification Customers

To avoid handling sensitive account information, verification customers can create secure account tokens (and revoke previously created tokens) for users’ verified financial accounts to share with Payment Processors.

- Create account token API – Allows to create a secure

processorTokenfor a user's verified financial account. ThisprocessorTokencan then be shared with the payment processor partners.Impacted API URL: - Delete account token – Allows revoking a previously generated processorToken. It is recommended to use this service to disallow further access to the user's financial account, for instance, when a user removes their account from the customer’s application.

Impacted API URL:

Payment Processor APIs

Envestnet | Yodlee's payment processor partners can use the Payment Processor endpoints to access verified account details using the processorToken created and shared by mutual customers.

The following APIs are only for payment processor partners and not for developers using the Envestnet | Yodlee services to integrate with payment partners:

- Get account holder details API – Retrieve the account holder information, such as name, email, phone number, address, etc., of the verified financial account associated with the

processorToken.Impacted API URL: - Get account details API – Retrieve account information such as account name, type, status, balance, account number, and transfer code (for example, routing number of the bank account in the US) of the verified account associated with the

processorToken.Impacted API URL: - Get balance details API – Retrieve the account balance information of the verified account associated with the

processorToken.Impacted API URL:

Yodlee APIs – New Features/Enhancements

Support for Asset Category Transfer

The newly introduced ACATS (Asset Category Transfer) product facilitates the data provision required for moving user assets from one brokerage firm to another. This requires passing the ACATS-specific configurations. Currently, this product is available only in the US locale.

ACATS requires the sites to have unmasked account numbers, and the accounts should be of Investment type. The GET account APIs will return two new attributes (if available) - dtcMemberClearingNumber and nsccClearingNumber - for accounts aggregated through the ACATS flow.

| Impacted API URLs: |

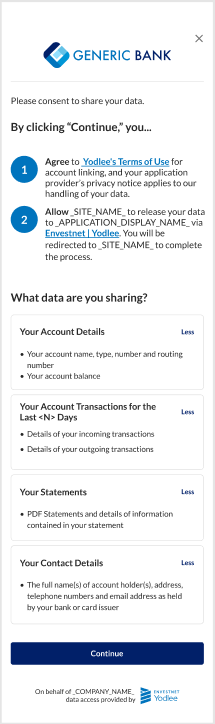

Open Banking – New Features/Enhancements

US Open Banking

Intent to Consent Screen Messaging Changes

The requested data information in the Intent to Consent screen has been changed for ease of understanding and to improve the user experience. The following changes have been made in the Intent to Consent screen:

- The Statements data cluster will only be displayed for the PDF statement download requests for the US sites.

- The improved Contact Details data cluster messaging will include account holder name(s) for the Account Verification requests.

These enhancements apply to:

- All Open Banking sites in the US region and users aggregating them.

- FastLink 4, FastLink 3, and Yodlee API customers.